Unfortunately, one of the results of the pandemic is that smaller competitors may be going out of business. This will create opportunities for the survivors. Is this an opportunity for your company? An add-on acquisition or merger, with a smaller company that fits your strategic direction, could be an excellent way to help you emerge even stronger. This could certainly be an opportunity to expand your customer list, add a region or geography, add technical capabilities and bring in other needed competences.

Despite the unprecedented uncertainties in the world, many companies are continuing to plan major transformations and more than half of those surveyed are planning to do this through Mergers and Acquisitions (M&A). 57% emphatically indicated they intend to continue to do strategic revenue growth deals according to E&Y’s Capital Confidence Barometer survey of more than 2,900 C-suite executives globally. Harvard Business Review is also reporting that only about half are pausing activities in this area. Nearly a quarter are pursuing distressed companies. This is not unlike the M&A activity after the 2008 financial crisis.

Probably the most active since the NASDAQ, the tech sector is already at record highs with the world turning to virtual and relying more on technology during the pandemic. Companies like Google, Verizon, Uber, and Amazon have all been active in acquiring companies that largely fill in products, services, and capabilities where there are gaps. Other industries that are directly or indirectly supporting the response to the pandemic, such as health care and PPE, are also identifying potential opportunistic acquisitions. At the same time, companies like Nestle, MasterCard, Morgan Stanley, Thermo Fisher, and, even, Royal Caribbean have fulfilled transactions in the last few months.

Several studies have shown that add-on acquisitions of smaller competitors with similar products and services tend to be generally more successful as typically these companies will already have all or most of the management capabilities, infrastructure and systems in place. Further, in most industries smaller competitors tend to get a lower multiple of earnings or EBITDA and this could enhance your value when the combination results in a higher multiple. In the current environment consider mergers as well as acquisitions. A merger could be consummated through a stock transaction with little or no cash. You may even find opportunities to partner based on commissions or payouts.

Follow a Disciplined Approach For Merger and Acquisitions

M&A can be complicated. Based on our experience and a review of the market, we suggest a disciplined approach and a process that can help you be more successful. This article outlines some of the key issues you should consider regarding your objectives, the M&A processes and the learnings from successes and failures from the past.

Opportunities for add-on mergers and acquisitions broadly fall into two categories: market consolidation and enabling acquisitions.

Market Consolidation

Here the add-on company is in the same products, services, and business segments. This is essentially increasing market share. Bain calls them “scale acquisitions.” The more successful acquisitions tend to consolidate market share where the acquired company offers the same products and or services in the same geographical footprint to the same channels and end-markets. There will usually be significant cost synergies. In some cases, especially with larger transactions, FTC regulations may apply.

Enabling Acquisitions

Enabling or “scope” acquisitions enable you to expand geographically, enter new channels, new end-markets or bring new products, technologies, and/or competencies to your business. When the acquisition enables entry into a new geography, channel, or end-market, a company is more likely to be successful if the acquired company sells the same or highly complementary products & services. With these types of acquisitions, you should be very careful when expanding outside your current products and services— as these tend to be more risky.

Of the success of acquisitions has shown that most acquisitions are not successful and fail to meet their objectives. Acquisitions of “new” products or services in a “new” geography or “new” channels or end-markets are the least successful. Thus you are less likely to be successful when you do not know the products, the services, the customers and are entering a new geography.

Improving Probability of Success

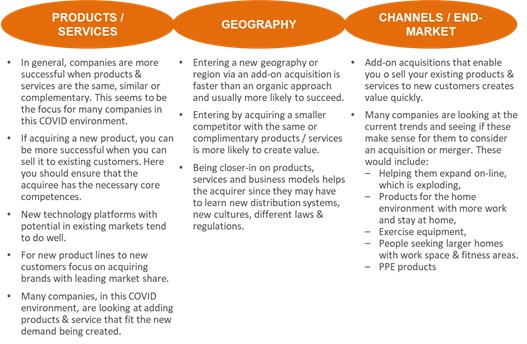

As you start this process of looking at your smaller competitors and even at similar products & services, here are some key considerations to improve your probability of success depending on whether you are acquiring a product / service, entering a new geography or a new channel / end-market:

A Mergers and Acquisitions Process to Follow

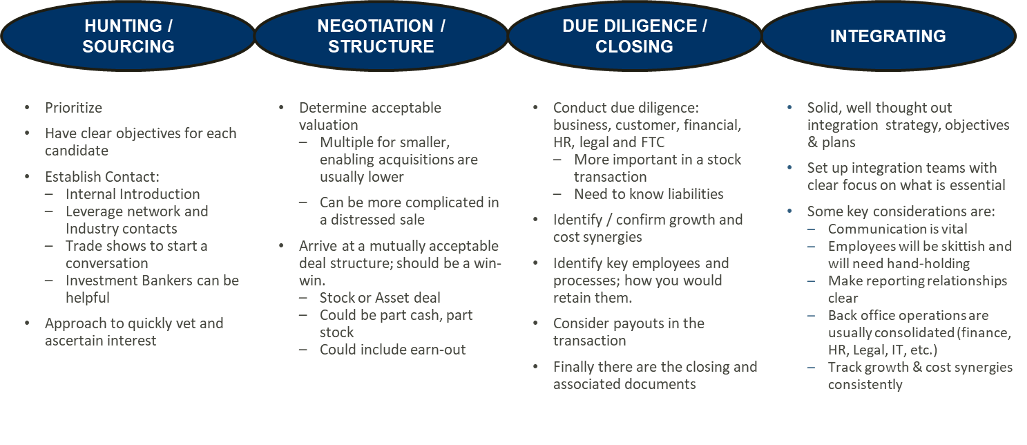

You should follow a very systematic and disciplined approach through the M&A process of sourcing, execution & integration. Many acquisitions are not successful. To help you avoid failure, we have identified the seven main reasons for not succeeding.

The first step is to gather information around which of your smaller competitors may be struggling. Your own knowledge and network will be helpful here. You can also talk to investment bankers who can provide leads, and there are outside resources available. Since it is expected that nearly a third of smaller businesses may not survive, it is worth looking at distressed sales as well.

You should plan to approach candidates quickly, vetting them and ascertaining whether there is any interest. As indicated earlier, be careful about any FTC regulations that may apply; your lawyers should be able to help you.

Once you have a list of potential candidates, prioritize them and have very clear objectives of why you want to pursue each one. This should be linked directly to your company’s strategy. Is the company seeking new technology? Is regional or geographic expansion a major thrust? Do you seek new end-markets or channels? Or is it a roll-up? A key question to ask is whether you have the management capabilities, infrastructure, and systems in place? Finally, is the opportunity close enough to reduce risks?

Below are the more common steps in the M&A process and can help you be more disciplined in your approach.

The initial negotiation is primarily around deal structure and valuation. Some considerations are that you expect to pay a lower multiple for a smaller player. You should, if possible, prefer an asset transaction as you leave the liabilities behind. Consider part cash, part stock deals – especially if you want the current owners to stay on after the merger. Once there is an agreement with a candidate to proceed further, there should be more detailed due diligence that could include business, customer, financial, and legal research.

In the COVID environment, it is important to pay special attention to the impact on sales, margins, customers, suppliers, employees, what work-from-home might mean in this particular case, or are employees furloughed, and how management handled the changes that have taken place. Law firms with M&A capabilities are available to help in the negotiations, develop the structure, and the closing documents. Remember that many of the companies pursuing M&A are looking for a bargain.

Finally, there is the integration, which is where many companies fail. A well thought out plan with clear objectives is needed. Some key things to remember: integrate what has to be integrated to achieve the objectives. Do not close plants unless you can pick up the manufacturing. The customer interface is critical. If the acquired company’’s core competencies are important, ensure that these are maintained. Both your employees and employees of the acquired company, need to clearly understand the process and expectations. Most companies will set up several integration teams, which can help make the integration more seamless.

Here are some things to consider to increase your probability of success:

- Communication is Vital: Starting with initial announcements through the complete integration process, employees need to know the strategic direction and, more importantly, what it means to them. Confusion and uncertainty leads to inefficiencies and loss of productivity. Communicating with other stakeholders is important as well: consider customers, industry partners, investment community, etc.

- Reporting Relationships. Clarity on reporting relationships is vital. Do this as soon as possible so that people understand the organization structure. For close-in acquisitions there are likely to be many more reporting relationships. For enabling acquisitions reporting may be limited to a few senior executives plus, at a minimum, the finance department, other back office operations, and possibly R&D/Engineering. Interestingly, one of the merger principles at Dow Chemical was that the CFO had to be a Dow person (even if the CEO was not).

- Decision Making Authority. Quickly determining and defining the key executives and integration team leaders with clear decision-making authority helps resolve people issues.

- Project or program structure can be deployed to manage the integration, especially for a larger transaction, with a mix of a small full time integration team and part time representation from the necessary functions. Having dedicated integration resources will help maintain business momentum with separate groups focusing on day-to-day operations.

- Key Employees & Retention Plans: It is important to identify key employees, even pre-closing, and evaluate if retention plans are needed. Competitors will go after these people or they can be out looking for jobs during the uncertainty

- Finance: A key priority is always cash management and processes for financial closings where systems can be an issue. You can use short term solutions such as downloading financial information, then building a bridge. No matter what you do, think about this ahead of time and have a plan in place.

- HR: Non-US acquisitions can be more straightforward because you can leave policies and procedures in place. In the US, you must consider the differences in benefits and processes. There may be a cost associated and transitions can be complicated.

- Legal: Laws differ from country to county and all outstanding legal issues must be identified with a plan on how to deal with these.

- Tracking Growth and Cost Synergies is essential to get the full value creation benefits. Focus on four to five areas that represent the greatest opportunities with clear, quantifiable goals and assigned responsibilities. As you learn more, open the aperture beyond traditional synergies to identify other value creation opportunities.

Learnings From Past Add-On Acquisitions

Here are some mini-case studies illustrating what works well and what does not.

- A leading US safety company entered the segment which produced communication headsets with hearing protection for noisy environments, which was an adjacent space, by acquiring a $40 million company with offices and manufacturing plants in Europe. Their success was based on a number of factors. The solid investment thesis was to expand the product line globally, plus target selected verticals: offshore oil & gas and the US military. Commercial staff was added to achieve this. In eight years, sales exceeded $100 MM million.

- The main European location is still in place. Several key manufacturing / assembly locations were added in the US and China.

- The reporting relationships were defined with focus on R&D, new products, finance, legal, and HR.

- An SBA was set up and experts were identified to lead this product line in specific new geographies. Sales people around the world were trained in selling these products.

- The products were introduced into the consumer channel for DIY consumers.

- A cutting and welding products company was the leader in cutting but not in welding products. It was in gas & plasma cutting and expanded into laser cutting by acquiring a small R&D company in that space, with sales of $2 million, annually. Very little integration was done for the first several years other than Finance, HR, and Legal. This was intended as an investment in developing new products for their existing customers. Additional enabling acquisitions in gas cutting were made to expand geographic presence, especially in Europe. Here the focus of seeking growth opportunities in a business segment where you are the market leader and have core competences helped more rapid value creation.

- A children’s products company selling to large retailers acquired a similar sized competitor. A large percentage of their sales were impulse purchases. Many of the key sales leaders were let go early resulting in a significant sales loss since they had the commercial relationship. Even after several years the company has not recovered. This underscores the need to retain key employees because those employees with the customer relationship can be vital.

- An environmental testing company has been acquiring very similar small, local testing labs which account for an estimated 40% – 50% of the market. They have built a dedicated M&A team. Most of the operations are quickly consolidated. However they leave in place local capabilities that receive test samples, deliver results and have the local customer contacts. This model has worked well. Many of the companies who are continuing to do acquisitions have dedicated M&A teams.

- Many Distributors are following a roll-up strategy to expand their geographic reach, but sticking to existing and similar product lines. They acquire smaller local distributors in regions where they have little or no coverage. In addition to gaining geography they are buying customer lists and, over time, reducing their costs to purchase as they become larger. Thermo Fisher has done a good job of executing this.

After a crisis, such as the one we’re currently in the midst of, may be a good time to look at Merger and Acquisition opportunities, especially of smaller competitors who may have been hard hit during these trying times. Many companies are doing this. We believe in these reasons for why Mergers and Acquisitions are important right now and can help you emerge even stronger. If you decide to pursue M&A, remember to follow a disciplined approach and be clear about the objectives for each acquisition candidate. You are likely to go through the four stages of hunting & sourcing, negotiating, due diligence & closing, and finally (probably the most critical) the integration. There are highly experienced resources available to help you through each step of the process.

In the integration days of your Mergers and Acquisitions, planning a coordinated approach to your marketing is crucial. Download our Marketing Planning Like a Pro workbook to put your best foot forward.

In a recent &Marketing webinar we dove deeper into the resulting business trends from COVID-19 and the necessary actions mid-market companies should take to build and sustain long-term growth. Watch the entire webinar below!