Welcome to part four of a five-part series of articles on “Emerging Stronger Post-Pandemic,” which has been specifically developed for mid-market companies. In the first article, we identified several key trends and discontinuities that have emerged from the pandemic (which smart business leaders will see as opportunities) and provided four areas that mid-market companies must focus on to not only survive, but thrive over the long-term. These four areas include:

- Redefining the customer experience

- Reviving your relationship with employees

- Restructuring your supply chain

- Rethinking and resetting your strategy

The articles in this series spotlight each of these core areas.

This article addresses the steps mid-market companies should take to manage disrupted supply chains, an area that has affected almost every company (94% of the Fortune 1000 companies have reported seeing coronavirus-driven supply chain disruptions). We explore both the immediate steps, as well as some of the more intensive, strategic issues that businesses will have to address in both the near and long-term future.

Key Supply Chain Issues

As the country begins to ‘reopen,” all of your vendors may not. Imports have stalled, especially from China. New vendors may require cash on delivery. Many smaller companies have had to shut down operations for these reasons, and over a third may not survive. A decade or two ago this scenario would have been less of an issue, as most businesses mainly operated closer to home. But today, companies have gone global, with significantly more offshore business and supply chains that extend around the world.

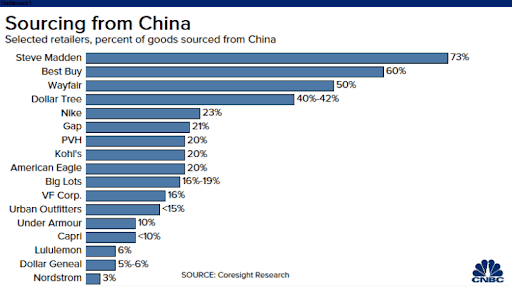

Single-sourcing is no longer a solution. When supply chains are disrupted, those who single source suffer. There are numerous examples of where this has become an issue – like the many PPE and medical supply companies who have learned this the hard way. In the solar energy space, electronics, computers, and other technology arenas, supply chain disruptions have been significant, as China supplies most of the solar cells to the world.

Another example is a manufacturing company that has 15 production sites, where some of their materials and technologies are single-sourced. They have faced hardships, not only because of the pandemic, but also due to natural disasters and strikes.

There is increasing discussion around manufacturing “essential supplies” domestically. This has become more and more important for PPE, medical supplies, and other “essential” products. Being on the high seas for weeks also does not help! While moving completely away from China will be difficult – especially for highly specialized products and components – diversified supply chains are emerging. Many U.S. businesses are looking at the Far East, Mexico, and Central America for additional suppliers. Apple is moving a part of its supply chain to India. Indonesia has made dramatic changes to become more “business friendly.” Mexico and Central America’s proximity makes them more attractive, with lower shipping costs and imports that aren’t on the high seas for weeks at a time. This is what PwC and AmCham call a ‘China+1’ strategy.

Immediate Steps

Identify items at risk in detail. Overall, companies need to granularly identify the items that are at high-risk and develop a realistic plan for moving forward. In addition, they need to be more flexible and agile, with greater visibility to suppliers and easier processes for onboarding new ones.

According to McKinsey, “Actions taken now to mitigate impact on supply chains can also build resilience against future shocks.” This includes reviewing bills of materials (BOMs) and catalog components to identify those that are sourced from high-risk areas and lack ready substitutes. McKinsey recommends first developing a risk index for each commodity, based on uniqueness and location of suppliers, followed by a realistic action plan. You must develop longer-term relationships with multiple suppliers, including domestic manufacturers.

Document and map supply chains to enable a sound go-forward strategy. Many supply chain and sourcing managers have formalized, documented commodity strategies for high-spend areas and critical raw materials and components. For each item sourced, be sure to include:

- Annual usage, volume and spend with historical, current, and future requirements;e

- Current supply base by spend and volume, whether domestic or imported;

- Current and potential suppliers of the commodity with their locations, annual capacity, and domestic and global supply;

- A supplier scorecard so that, in a crisis, you have data to understand potential problems with suppliers;

- Material cost drivers of the raw material and historical costs, and a SWOT analysis of the commodity category and your current situation with your suppliers (i.e. expiring agreements, no agreement, volume commitments, exit clauses, favored nation clauses, etc.);

- Because your volume is small, if buying from Distribution, track all the way back to the original equipment manufacturers (OEMs). As your volume grows, you may be able to go direct and get a better price.

Without data, you’re just another person with an opinion

W. Edwards Deming

The information outlined above should culminate in a go-forward strategy that includes business interruption tactics, and you should periodically test the waters by getting bids from a number of companies. This data will be valuable in a crisis, similar to when U.S. tariffs were put in place. Here, you should look at “landed cost” and include the cost of money for incremental in-transit and material storage when sourcing from alternative suppliers.

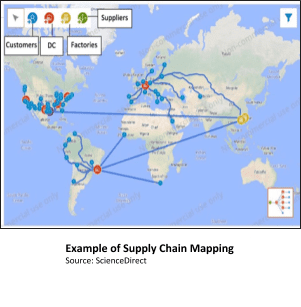

With more complex supply chains, it may be worthwhile to do limited mapping, and document the supply chain from raw material to finished products. This process entails engaging across companies and suppliers to document the exact source of every material and every process involved in bringing goods to market. It is complex, as it traces a product all the way from its raw materials. This approach was first developed at MIT in 200,8 and became easier and more accurate with online maps and the social web. They have also made retrieval and updating easier.

Capture immediate cost reductions. Finally, you should capture immediate cost reductions during a period of turmoil, such as lower freight rates due to excess capacity, lower prices as demand has dropped sharply, etc.

Want to understand if your setting yourself up to emerge strong post pandemic? Request a readiness assessment today and find out.

The Future May be More Complex

Once you handle the more immediate actions, below are areas you must start to consider, some of which many companies have already started to implement.

Recognize that building a new supply chain will take time and effort. Your problems may be more severe if your supply chain is international. What should you do about disruptions in the future? Many companies are looking to multi-source and, where possible, are looking to manufacture closer to home. Mexico and countries in Central America, while more expensive, are advantageous because of free trade agreements and shorter supply chains.

Simplify and hasten the onboarding process. Many companies have realized they need to onboard new suppliers more quickly and make the process less complicated, especially for more critical parts, components, or ingredients. With or without a pandemic, you must have a well-documented but simpler and more flexible Standard Operating Procedure (SOP) for onboarding suppliers.

Don’t mark China off completely. A defining issue for many manufacturers in the “new normal” will be developing supply chain resilience and considering options beyond China. This is indeed important as we must recognize that China will still remain attractive as a manufacturing location. There is unlikely to be a clean break. Though for some labor intensive sectors, like apparel, it will be faster and easier, as many have already moved to Vietnam, Cambodia, and India, based on rising labor costs in China. However, for higher value-add businesses, like technology, consumer electronics, and pharmaceutical ingredients, China has built great capabilities, making their partnership more difficult to replace.

With more complex supply chains, it may be worthwhile to do limited mapping, and document the supply chain from raw material to finished products. This process entails engaging across companies and suppliers to document the exact source of every material and every process involved in bringing goods to market. It is complex, as it traces a product all the way from its raw materials. This approach was first developed at MIT in 200,8 and became easier and more accurate with online maps and the social web. They have also made retrieval and updating easier.

Be conscious of the growing demand in developing markets. For more global companies, a second issue is the growing demand in developing countries. McKinsey estimates that “emerging markets will consume almost two-thirds of the world’s manufactured goods by 2025, with products such as cars, building products, and machinery leading the way.” This will impact the approach to revamping supply chains so that they’re closer to their end markets.

Technology businesses must realize that this process will be more difficult for them. For most companies – even the Fortune 500 – to possess all the skills and competences necessary to be vertically integrated, many focus on the competences that give them their competitive advantage. Therefore, they have increasingly turned to specialists and subcontractors who narrowly focus on one area and are found in specific geographic regions. Smartphones, medical equipment, precision instruments and even desk lamps with LEDs are made in high-tech factories with specialization, sophisticated tools, and highly trained people. Further, the suppliers of such products may in turn depend on many others to provide sub-systems.

Basically all of the world’s computer parts come from the same supply chain that runs from Korea, down through coastal China, over to Taiwan, and down to Malaysia

Thomas Friedman

Know that cost and capital will be key drivers. The global supply chains we find today (particularly in the Far East) have been built to deliver cost reduction and increasing efficiencies. This complex manufacturing-and-delivery system that provides products at relatively low cost has taken decades to evolve and will be difficult to replace.

Countries themselves have started to specialize, such as India in IT, Taiwan in consumer electronics, Singapore in chemical compounds, and Ireland in medical equipment. Supply chains are tiered with automakers dealing primarily with first-tier suppliers, who in turn manage a second and even third tier. Even N95 masks made in the U.S. by 3M uses “globally sourced materials.”

The issues are more complex in many high-tech cases, where the capital investment needed to build and equip plants can be several billion dollars. These plants, in turn, can be dependent on a variety of suppliers for components and parts.

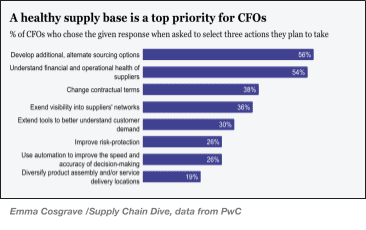

Lean manufacturing has resulted in low inventory in the system, which, with a pandemic, can result in shortages more quickly. Many business leaders (see the CFO survey below) are increasing inventory levels.

One thing to remember is that, if tensions with China escalate (for a variety of possible reasons), so will the chances of renewed tariffs.

Potential Steps to Start Reducing Ris

While building more resilient supply chains will take time, a healthy supply base is a top priority, based on a PwC survey of CFOs. Here are some steps they are either already implementing or considering. This may help you consider alternatives that fit your business.

Technology businesses must realize that this process will be more difficult for them. For most companies – even the Fortune 500 – to possess all the skills and competences necessary to be vertically integrated, many focus on the competences that give them their competitive advantage. Therefore, they have increasingly turned to specialists and subcontractors who narrowly focus on one area and are found in specific geographic regions. Smartphones, medical equipment, precision instruments and even desk lamps with LEDs are made in high-tech factories with specialization, sophisticated tools, and highly trained people. Further, the suppliers of such products may in turn depend on many others to provide sub-systems.

- Multi-shoring to reduce risks (this is the most common approach thus far).

- Carrying higher inventory with the associated increase in warehousing space.

- Building longer-term business relationships with fewer suppliers, reframing them as strategic partners and leveraging their capabilities.

- Regionalizing production in distinctive areas such as North and Central America, the European Union, and Asia-Pacific.

- Leveraging automation to improve the speed and accuracy of decision-making, with a focus on automating data collection and analysis of supply chain effectiveness (PwC).

In Conclusion

To ensure you are one of the businesses that makes it to the other side of this pandemic, you must seize this moment in history as an opportunity to assess your supply chains and take action to improve your resilience moving forward. As a start, identify – at a detailed level – the products and materials that are at high risk, and develop a realistic plan going forward. Longer term, some steps you must consider include:

The pandemic has been and will continue to be a major shock to global supply chains and sourcing strategies

Harvard Business Review

- Diversify your sources for critical components and materials. This includes geographic diversification, partnering with the same supplier, or using secondary sources when feasible. If you are highly dependent on China, consider the China+1 strategy.

- Build higher levels of safety stock or strategic inventory reserves. Higher inventories of, at the least, critical raw materials and even finished goods can make sense, especially for “essential” items.

- Do not single source, especially for high risk items. Build partnerships with a few suppliers. In addition to reducing disruption risks, this can have additional benefits such as access to more capabilities, more ideas for cost reductions, product improvements and even new products by leveraging these partnerships.

- Ensure that transportation is not a bottleneck. This is one reason companies are looking to have supply options closer to home.

- Leverage Governments subsidizing extra capacity or stockpiling for critical items. This could be similar to the US oil reserves of the past.

The COVID-19 pandemic and trade wars have together highlighted the brittleness of our global supply chains and trading systems, reminding businesses that the risk of an unexpected, disruptive event is ever-present. Managers should heed the lessons, be proactive in their planning, build more resiliencies into their operations, increase visibility, and create processes that are easier to manage.

As we continue to work our way through and eventually emerge from this pandemic, the words from DuPont’s CEO following the 2008 financial crisis should resonate:

The death of globalization and world-encompassing supply chains has been foretold so often that it is hard to imagine it might actually be happening

Financial Times

“There is no playbook for what the world is experiencing right now,” Kullman said. She went on to note, though, that during its 207-year history, DuPont had already innovated through downturns. “None of that happened by accident. It took leaders who had a vision and were absolutely determined to not waste a good crisis. We must be prepared not for the world the way it was before …. but prepare to succeed in the very different world that we’ll encounter when the recovery eventually comes”.

In a recent &Marketing webinar we dove deeper into the resulting business trends from COVID-19 and the necessary actions mid-market companies should take to build and sustain long-term growth. Watch the entire webinar below!

About the Authors

Rahul Kapur has 40+ years of successful business experience spanning a variety of areas. As a business consultant, he provides companies of all sizes with his expertise in strategy development, M&A, new products & innovation, and data analysis and modeling. His experience includes Unilever, Dow Chemical and Aearo Technologies (now 3M). He is Managing Director of Icon Investment Partners, Chairman of Guilford Group, Managing Member of Ark Capital Investments, LLC, and Senior Advisor for &Marketing, Crossroad Transactions, and Quest Safety Products, as well as on the boards of several start-ups.

Robert Olsen is a Marketing Expert, Speaker and Consultant with a unique combination of Management Consulting and C-suite experience in chemicals and life sciences. He is an experienced Chief Marketing Officer, and has also served as Corporate Marketing Director at DuPont and a Strategy and Operations Consultant at Deloitte. Robert helps companies grow, utilizing his expertise in marketing, sales, and innovation to navigate major changes and new programs including M&A, brand building, and culture transformations. Robert is passionate about creating a better customer experience and employee culture to drive business results.

Jim Floyd has over 30 years of successful business experience in general management, supply chain management, and international operations at organizations such as Proctor & Gamble and DowBrands, Aearo Technologies (now 3M), and Icon Investment Partners. Jim has helped a number of companies improve their supply chains, both by improving their efficiencies, and helping them reduce costs.